Charitable Gift Annuity

A gift that secures lifetime income and shares the gospel.

A Charitable Gift Annuity (CGA) is a dual-purpose gift that can help balance your need for predictable income with your desire to make a gift to support your favorite Cru ministries or missionaries.

When you fund a CGA with cash or publicly traded securities, you make a gift to the ministry and receive an income from Cru Foundation. It’s a win-win for many people.

Explanation of Benefits

Income tax deduction

A portion of your gift is tax-deductible. The deductible amount is determined by your age, the type of asset and rates established by the federal government. We calculate the tax-deductible amount for you.

Attractive payout rates

The amount of the annuity payment is determined by your age. The older you are, the higher the rate. See the tables for examples.

Designate your gift

Your CGA can be used to support Cru projects or ministry, including the ministry of missionary staff, when you no longer need the income.

Flexibility

Income payments can be made for the lifetimes of one or two people. You may also choose to defer payments to a time when the income will be needed.

A story from someone like you

Linda’s generosity will make an eternal kingdom impact through the Jesus Film Project. And the annuity ensures Linda of an income for life, too. Like Linda, you can establish a charitable gift annuity that supports the work of Cru missionaries and ministries closest to your heart.

Story of CGA gift – Linda Todd

Growing up in a Christian home, Linda Todd always had a heart for people. She worked as a licensed practical nurse caring for the sick and elderly. In 2007, Linda moved back home to care for her aging parents until they passed. “I learned a lot just by being a servant to others. I had to depend on God,” Linda shared.

When Linda received her portion from her parents’ estate, she wanted it to go to the Lord’s work. She thought, “I could go to heaven before I’ve done anything with this money. It was a gift to me, so I don’t want to squander it. It should go to God because He provided it.”

She learned about a charitable gift annuity through Cru Foundation and thought about whether a combination of a gift with an income benefit was right for her. She prayed and talked it through with a Cru Foundation Gift & Estate Design Specialist. “God helped me to see that this is something that could help me and that the more I have, the more I can give. So I am grateful for it,” Linda says.

Linda’s generosity will make an eternal kingdom impact through the Jesus Film Project. And the annuity assures Linda of an income for life, too. Like Linda, you can establish a Charitable Gift Annuity that supports the work of Cru missionaries and ministries closest to your heart.

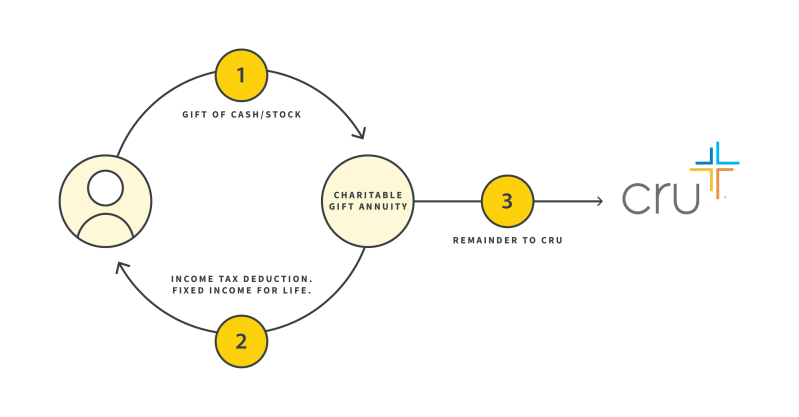

How It Works

To get started, you can contact our team to request a Charitable Gift Annuity illustration. Once you’ve decided on the gift, here is an overview of how it works:

Complete the CGA application and establish the CGA with a donation of $5,000 or more

Receive fixed lifetime payments on a quarterly schedule for the lifetimes of up to 2 people.

After all payments have been made, your gift accelerates gospel work through your favorite Cru ministries and missionaries!

After all payments have been made, your gift accelerates gospel work through your favorite Cru ministries and missionaries!

Annuity Payments

Payments are fixed for life and can be made to you, your spouse and/or a loved one. The amount of each payment will depend on the age of the person(s) who receives them.

We live in an uncertain world, but with a CGA, there are two things you can count on. Your investment will share the gospel through Cru, AND you will receive regular income at a fixed rate no matter the condition of the stock market. And over Cru Foundation’s 50 years of existence, we have never missed a payment.